As a technology industry analyst tracking the intersection of finance and digital transformation, the rapidly evolving risk landscape shows a dramatic shift in how CFOs approach risk management. That’s why data from Chubb’s recent survey of business risk decision-makers, the Chubb Risk Decisions 360°: Emerging Risks that Can Impede Sustainable Company Growth report, caught my eye. The Chubb data reveals a landscape where traditional financial concerns are increasingly intertwined with technological and cybersecurity threats — and that is not at all surprising.

Cybersecurity Threats Remain a Dominant Concern

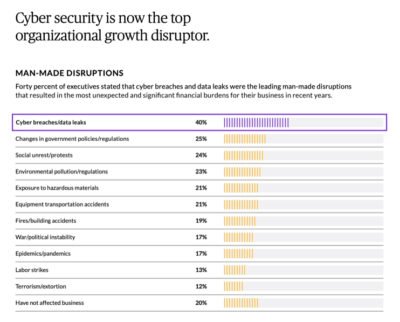

The Chubb survey results on the evolving risk landscape indicate it is abundantly clear that cybersecurity imperative stands out as the dominant concern for CFOs, with 40% of risk decision-makers identifying data breaches as their primary source of unexpected, man-made financial disruption.

This statistic isn’t surprising, given the sophistication of modern cyber threats and the increasing value of digital assets. What’s particularly telling is that nearly 90% of businesses are actively expanding their cyber insurance coverage — a clear indication that CFOs are treating cybersecurity not just as an IT issue but rather as a fundamental financial risk — and that’s as it should be. The majority of responding organizations of all sizes view cyber attacks as a top threat: SMB – 66%, Mid-market companies — 68%, and Enterprises – 74% and more than half of executives surveyed (56%) indicate they view data breaches and malware as their top concerns.

Here’s a glimpse at the Chubb data illustrating the man-made disruptions they worry most about:

It is somewhat alarming to see that only a little over half of the survey respondents indicated they have business interruption coverage in place in the event of a cyber attack, supply chain disruption, or natural disaster. I’m not sure what they are waiting for.

CFOs Understand the Importance of Data Integrity

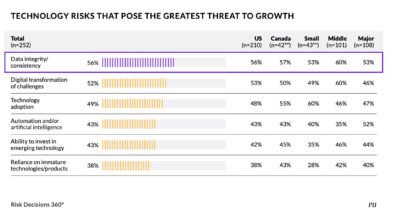

In today’s data-driven world, data integrity is something every organization is working hard to get arms around. Data integrity was identified in the Chubb survey as most significant technology-specific threat, cited by 56% of respondents. This reflects a crucial reality: in an era where data drives business decisions, unreliable or compromised data represents an existential threat to organizational success.

As you can see from the chart above, the concern about data integrity is closely followed by digital transformation challenges (52%) and new technology adoption (49%), suggesting that CFOs are grappling with both the opportunities and risks presented by technological advancement.

Traditional Financial Risks Haven’t Gone Away

Traditional financial risks haven’t disappeared — they’ve evolved. Cash-flow management remains a top concern for 59% of respondents, while inflation and interest rate risks worry 54%. However, these traditional challenges are now complicated by modern factors like supply chain digitization and real-time payment systems. The Chubb survey indicates that 53% of risk leaders view supply chain disruptions as a critical operational threat, highlighting how digital transformation has made supply chain resilience a key financial consideration.

Navigating a global pandemic came with a silver lining or two, and one that I often mention is that it helped spur a growing awareness around the importance of supply chain resilience. In the past, it was not unusual for both consumers and businesses to take supply chain and its perceived resilience for granted, but today, we know better. The pandemic, combined with the cargo ship the Ever Given getting stuck in the Suez Canal and blocking the flow of goods to and from Europe, the Middle East, and Asia, was another well needed wake up call. That incident, which is still being litigated, caused worldwide supply chain problems and losses were estimated at $400 million per hour, and $10 billion per day.

The Growing Adoption of Risk Management Tools

What’s particularly noteworthy, and something that’s very good to see, is the increasing integration of risk management tools. The fact that six different risk mitigation approaches are being regularly used by over 80% of respondents suggests that CFOs are adopting a more sophisticated, multi-layered approach to risk management. Continuous monitoring of cyber incidents, combined with employee training and systematic risk assessments, indicates a shift toward more proactive risk management strategies.

Environmental risks have also gained prominence in CFOs’ risk calculations, with natural disasters being cited as a significant source of financial disruption. This trend, combined with increasing regulatory attention to environmental issues, suggests that CFOs are having to develop more comprehensive approaches to managing environmental risks and their financial implications.

In my conversations with CFOs as well as with technology vendors, it is clear they are also seeing that technology solutions that can help manage procurement, supply chain, keep up with quickly changing regulatory requirements, etc. are quickly becoming business mission critical. Not surprisingly, a whopping 79% of respondents indicated they are implementing AI in areas like risk assessment and mitigation. On a less than positive note, 36% of the Chubb survey respondents indicated they don’t believe their companies are effective at mitigating risk. I would say they are one financial disaster away from realizing this needs to be a priority.

Looking Ahead: Building Resilient Organizations

Looking ahead, the convergence of technological and financial risks will likely continue to reshape the CFO’s role. The high percentage of organizations planning to increase their cyber insurance coverage (89%) suggests that financial leaders are preparing for a future where digital risks are even more central to financial planning and risk management strategies.

For CFOs navigating this complex risk landscape, the key to success appears to lie in building resilient organizations and developing integrated risk management frameworks that can address both traditional financial risks and emerging technological threats while maintaining the agility to respond to rapid changes in the business environment. This includes continuous monitoring for cyber risks and reporting incidents in a timely fashion and conducting ongoing employee training and education and creating a culture around security and business resilience. It also includes doing regular risk assessments, conducting qualitative and quantitive analyses, having third-party vendor management operations firmly in hand, and planning for different scenarios to ensure preparedness and readiness. Most importantly, it is imperative that organizations realize that insurance alone is not enough to protect an organization from risk.

Best-in-class organizations are also embracing supply chain technology solutions that help make navigating this risk landscape less onerous — and I have no doubt we’ll see more of this moving forward.

To access the full Chubb Risk Decisions 360°: Emerging Risks that Can Impede Sustainable Company Growth report, download it here.